Februrary 11, 2011

Dear Shareholder:

We are pleased to enclose a Notice and Proxy Statement for the special meeting of the shareholders of First Focusthe Tributary International Equity Fund, (the “Fund”), a series portfolio of Tributary Funds, Inc. (“First Focus”(the "Company''). The special meeting is scheduled to be held on May 3, 2010March 7, 2011 at 10:0010 a.m. Central Time (the “Meeting”) at the offices of First Focus,the Company, located at 1620 Dodge Street, 16th Floor, Omaha, Nebraska 68197. Please take the time to read the proxy statement and cast your vote.

The purpose of the Meeting is to seek your approval on the election and re-election of the Board of Directors, to seek your approval on the filling of an existing vacancy on the Board of Directors, and to seek your approval on matters related to the approval of a new investment advisorysub-advisory agreement for First Focus,the Company, on behalf of each series of First Focus (each, a "Fund" and together, the "Funds"Fund, between Tributary Capital Management, LLC, the investment adviser to the Fund (“Tributary”), and new sub-advisory agreements for certainKleinwort Benson Investors International Ltd., currently the sub-adviser to Tributary on behalf of the Funds, including a potential name change for the Funds.Fund on an interim basis (“KBI”).

The Board of Directors has concluded that all the proposalsproposal included in thethis proxy statement areis in the best interests of First Focusthe Fund and its shareholders (the “Shareholders”) and recommend that Shareholders vote in favor of each proposal for which they are eligible to vote. For your added convenience, there is a summary at the beginning of the proxy statement that briefly describes eachsuch proposal.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

Sincerely,

Michael SummersStephen R. Frantz

President and Chairman

FIRST FOCUSTRIBUTARY FUNDS, INC.

ONE FIRST NATIONAL CENTER

1620 DODGE STREET

OMAHA, NEBRASKA 68197

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To the shareholders of First Focusthe Tributary International Equity Fund (the “Fund”), a series portfolio of Tributary Funds, Inc. (the “Company”):

A special meeting of the shareholders (the “Shareholders”) of the First Focus Funds, Inc. ("First Focus'')Fund will be held on May 3, 2010March 7, 2011 at 10:0010 a.m. Central Time (the "Meeting'') at the offices of First Focus,the Company, located at 1620 Dodge Street, 16th Floor, Omaha, Nebraska 68197, for the following purposes:purpose:

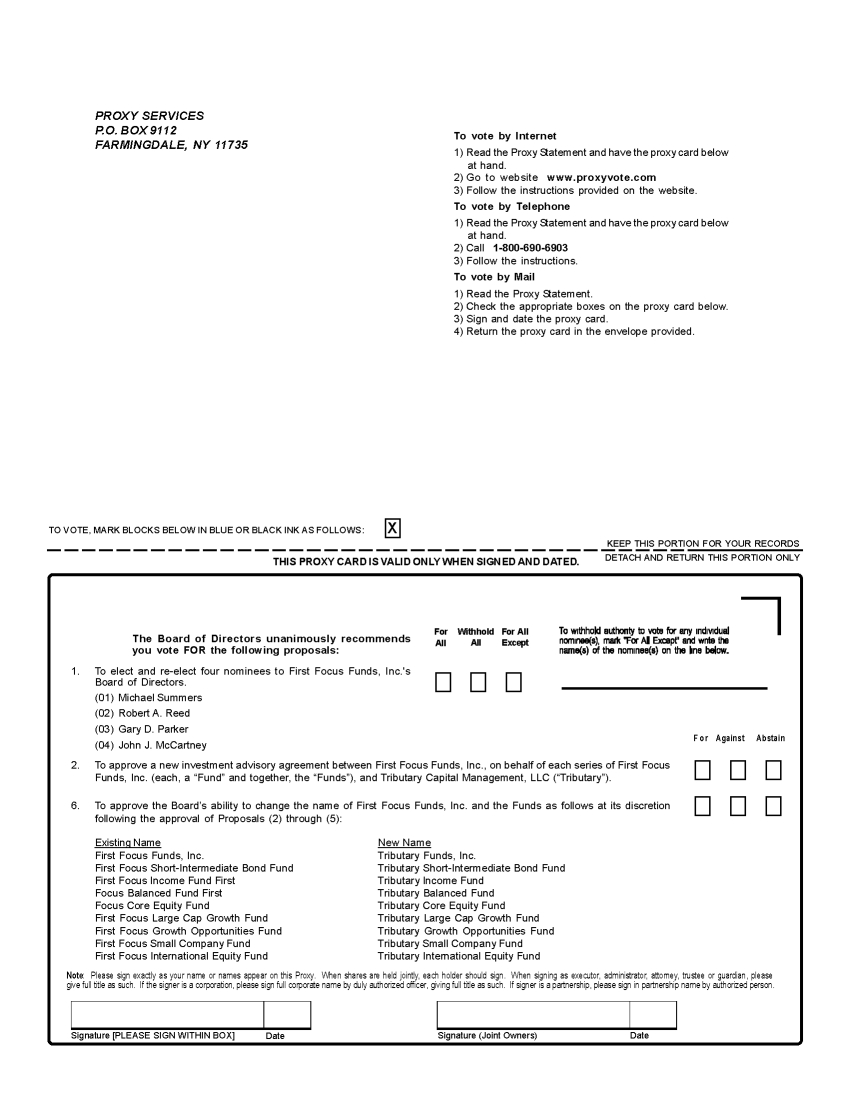

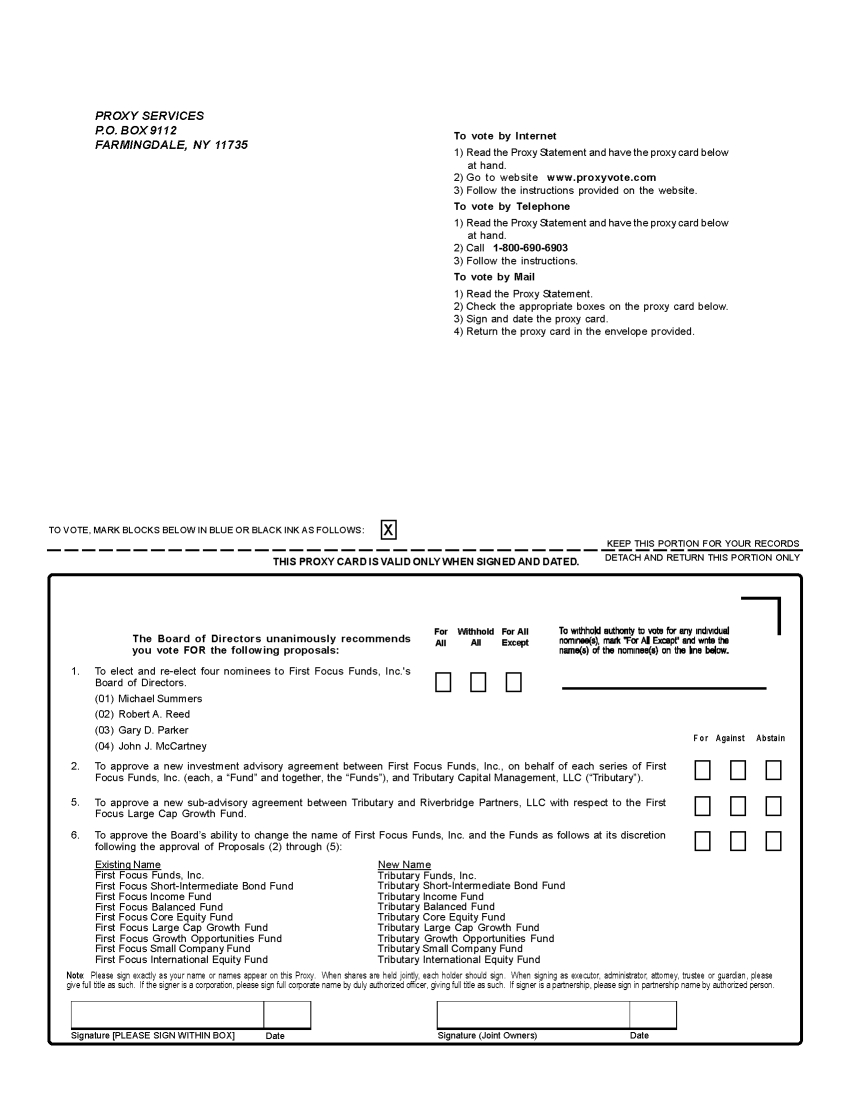

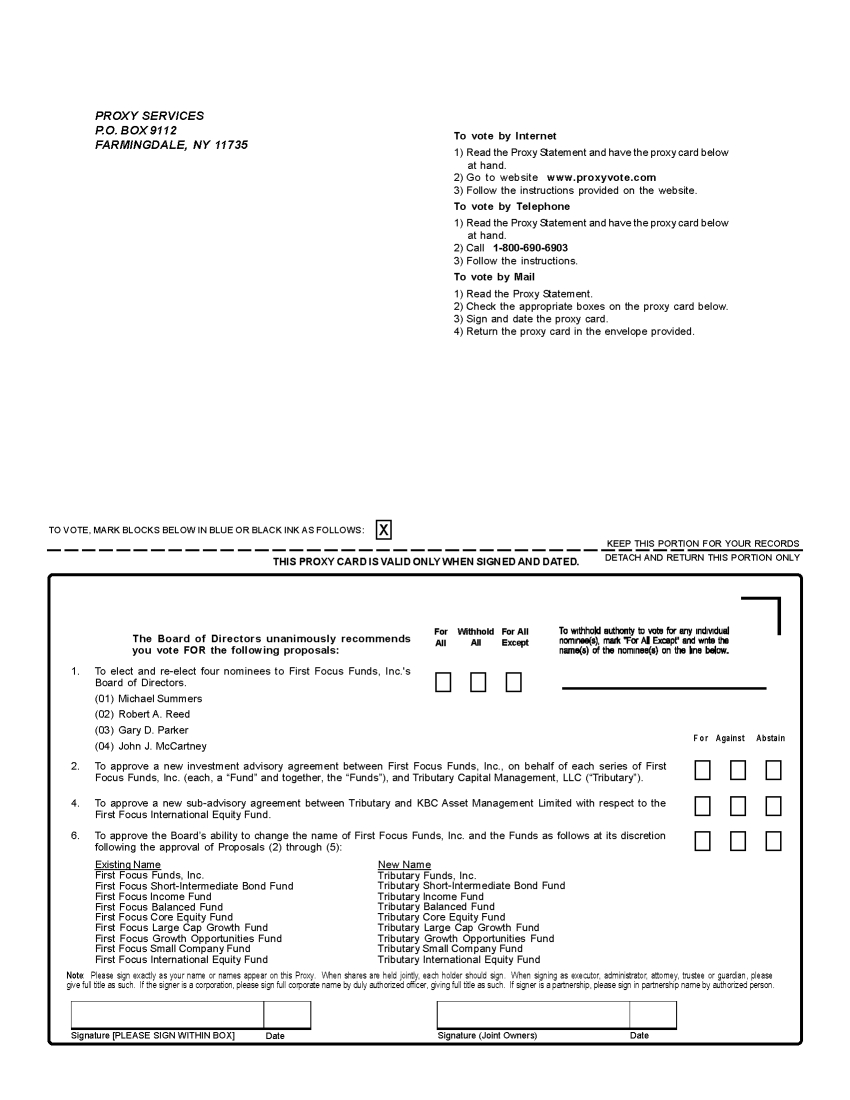

(1) | To elect and re-elect four nominees to First Focus’ Board of Directors, including the filling of an existing vacancy on the Board of Directors. This proposal applies to all Shareholders. |

(2) | To approve a new investment advisory agreement between First Focus, on behalf of each series of First Focus (each, a "Fund" and together, the "Funds"), and Tributary Capital Management, LLC (“Tributary”). This proposal applies to all Shareholders.

|

(3) ■ | To approve a new sub-advisory agreement between Tributary Capital Management, LLC and First National Fund Advisers, a newly-formed division of First National Bank in Fort Collins, Colorado,Kleinwort Benson Investors International Ltd. with respect to the First Focus Balanced Fund. This proposal applies to Shareholders of the First Focus Balanced Fund only. |

(4) | To approve a new sub-advisory agreement between Tributary and KBC Asset Management Limited with respect to the First Focus International Equity Fund. This proposal applies to Shareholders of the First Focus International Equity Fund only. |

(5) | To approve a new sub-advisory agreement between Tributary and Riverbridge Partners, LLC with respect to the First Focus Large Cap Growth Fund. This proposal applies to Shareholders of the First Focus Large Cap Growth Fund only. |

(6) | To approve the Board’s ability to change the name of First Focus and the Funds as follows at its discretion following the approval of Proposals (2) through (5): |

Existing Name | New Name |

First Focus Funds, Inc. | Tributary Funds, Inc. |

First Focus Short-Intermediate Bond Fund | Tributary Short-Intermediate Bond Fund |

First Focus Income Fund | Tributary Income Fund |

First Focus Balanced Fund | Tributary Balanced Fund |

First Focus Core Equity Fund | Tributary Core Equity Fund |

First Focus Large Cap Growth Fund | Tributary Large Cap Growth Fund |

First Focus Growth Opportunities Fund | Tributary Growth Opportunities Fund |

First Focus Small Company Fund | Tributary Small Company Fund |

First Focus International Equity Fund | Tributary International Equity Fund |

The proposal to change the nameBoard of First Focus applies to all Shareholders. The proposal to change the name of a Fund applies to ShareholdersDirectors of the respective Fund.

The BoardCompany has fixed the close of business on April 1, 2010January 21, 2011 as the record date for determining Shareholders who are entitled to notice of, and to vote at, the Meeting and any adjournment thereof.

You are cordially invited to attend the Meeting. Shareholders who do not expect to attend the Meeting are requested to complete, sign, and return the enclosed proxy promptly.

The enclosed proxy is being solicited by the Board of Directors of First Focus.the Company.

Your vote is important. Whether or not you plan to attend the meeting, please vote.

By Order of the Board of Directors

Toni BugniEvan Williams

Secretary

April 22, 2010February 11, 2011

| IMPORTANT—We urge you to sign and date the enclosed proxy card and return it in the enclosed addressed envelope, which requires no postage and is intended for your convenience. You may also vote through the internet by visiting the website address on your proxy card or by telephone by using the toll-free number on your proxy card. If you can attend the Meeting and wish to vote your shares in person at that time, you will be able to do so. |

PROXY STATEMENT

FIRST FOCUS

TRIBUTARY FUNDS, INC.

ONE FIRST NATIONAL CENTER

1620 DODGE STREET

OMAHA, NEBRASKA 68197

SPECIAL MEETING OF SHAREHOLDERS OF

FIRST FOCUSTRIBUTARY INTERNATIONAL EQUITY FUND,

A SERIES PORTFOLIO OF

TRIBUTARY FUNDS, INC.

May 3, 2010March 7, 2011

SOLICITATION OF PROXIES ON BEHALF OF THE

FIRST FOCUS FUNDS, INC. BOARD OF DIRECTORS OF

TRIBUTARY FUNDS, INC.

This proxy statement (“Proxy Statement”) is furnished in connection with the solicitation of proxies on behalf of the Board of Directors (the “Board”) of First FocusTributary Funds, Inc. (“First Focus”(the “Company”) for use at a special meeting of shareholders of each series the of First Focus funds (the “Shareholders”) of the Tributary International Equity Fund (the “Fund”), a series portfolio of the Company, for the purposespurpose set forth in the accompanying Notice of Special Meeting of Shareholders (“Notice”) to be held at 10:00 a.m. Central Time on May 3, 2010March 7, 2011 (the “Meeting”), at the offices of First Focus,the Company, located at 1620 Dodge Street, 16th Floor, Omaha, Nebraska 68197, and at any adjournment of the meeting. The approximate mailing date of this Proxy Statement is April 22, 2010.February 18, 2011.

Important Notice Regarding the Internet Availability of Proxy and Other Materials for the Meeting:

This Proxy Statement and the accompanying Notice of Special Meeting of Shareholders and form of proxy card also are available on First Focus’the Company’s website at:

www.firstfocusfunds.comwww.tributaryfunds.com/FinancialReports/financialReports.htm

Broadridge Financial Solutions, Inc., located at 51 Mercedes Way, Edgewood, New York 11717 has been engaged to assist in the solicitation of proxies for First Focus,the Company, at an estimated cost of approximately $12,000$2,000 plus expenses. In addition, First Focusthe Company may request personnel of the Co-Administrators (as defined herein) to assist in the solicitation of proxies for no separate compensation. It is anticipated that First Focusthe Company will request brokers, custodians, nominees, and fiduciaries who are record owners of stock to forward proxy materials to their principals and obtain authorization for the execution of proxies. Upon request, First Focusthe Company will reimburse the brokers, custodians, nominees, and fiduciaries for their reasonable expenses in forwarding proxy materials to their principals. FNB Fund AdvisersKleinwort Benson Investors International Ltd. (“KBI”) will bear the c ostcost of soliciting proxies.

The Board has fixed the close of business on April 1, 2010,January 21, 2011, as the record date (the “Record Date”) for the determination of Shareholders entitled to notice of and to vote at the Meeting and at any adjournment or postponement thereof. Shareholders on the Record Date will be entitled to one vote for each share of a particular series of First Focus (each, a "Fund" and together, the "Funds")Fund held in his or her name, with proportional voting rights for fractional shares. Based upon the records of First Focusthe Company and the Funds’Company’s transfer agent, persons who beneficially or of record own more than five percent of athe Fund’s outstanding shares as of the Record Date are listed in Appendix E.B. Prior to completing the attached proxy cards, Shareholders should review all voting information presented below unde runder “Additional Information About First Focus.”

SUMMARY OF PROPOSALS

While you should read the full text of this Proxy Statement, here is a brief summary of each of the proposals and how it will affect the Funds.

The following proposals will be considered and acted upon at the Meeting:

(1) | election and re-election of the current Directors as well as a new Director nominee to fill an existing vacancy on the Board; |

(2) | approval of a new investment advisory agreement (the “New Investment Advisory Agreement”) between First Focus, on behalf of each Fund, and Tributary Capital Management, LLC (“Tributary”); |

(3) | approval of a new sub-advisory agreement (the “New First National Sub-Advisory Agreement”) between Tributary and First National Fund Advisers (“FNFA”), a newly-formed division of First National Bank in Fort Collins, Colorado (“FNBFC”), with respect to the First Focus Balanced Fund; |

(4) | approval of a new sub-advisory agreement (the “New KBC Sub-Advisory Agreement”) between Tributary and KBC Asset Management International Limited (“KBC”), with respect to the First Focus International Equity Fund; and |

(5) | approval of a new sub-advisory agreement (the “New Riverbridge Sub-Advisory Agreement”) between Tributary and Riverbridge Partners, LLC (“Riverbridge”), with respect to the First Focus Large Cap Growth Fund. |

(6) | upon approval of Proposals (2) through (5), approve the Board’s ability to change the name of First Focus and the Funds at its discretion as follows: |

Existing Name | New Name |

First Focus Funds, Inc. | Tributary Funds, Inc. |

First Focus Short-Intermediate Bond Fund | Tributary Short-Intermediate Bond Fund |

First Focus Income Fund | Tributary Income Fund |

First Focus Balanced Fund | Tributary Balanced Fund |

First Focus Core Equity Fund | Tributary Core Equity Fund |

First Focus Large Cap Growth Fund | Tributary Large Cap Growth Fund |

First Focus Growth Opportunities Fund | Tributary Growth Opportunities Fund |

First Focus Small Company Fund | Tributary Small Company Fund |

First Focus International Equity Fund | Tributary International Equity Fund |

Shareholders of each Fund will vote separately for the New Investment Advisory Agreement, the applicable sub-advisory agreements, and the name change of the respective Fund. The following table lists the Shareholders of which Funds vote on these proposals.

Proposal

| Shareholders Entitled to Vote |

Election of Directors: Elect and re-elect current directors as well as a new director nominee to the Board

| Shareholders of all Funds, voting together |

Advisory Agreement: Approve the New Investment Advisory Agreement between First Focus and Tributary, to become effective upon consummation of the Tributary Transactions, as described below

| Shareholders of each Fund, voting separately by Fund |

First National Fund Advisers Sub-Advisory Agreement: Approve the New First National Sub-Advisory Agreement between Tributary and First National Fund Advisers, to become effective upon the consummation of the Tributary Transactions, as described below

| Shareholders of the First Focus Balanced Fund |

KBC Sub-Advisory Agreement: Approve the New KBC Sub-Advisory Agreement between Tributary and KBC, to become effective upon the consummation of the Tributary Transactions, as described below

| Shareholders of the First Focus International Equity Fund |

Riverbridge Sub-Advisory Agreement: Approve the New Riverbridge Sub-Advisory Agreement between Tributary and Riverbridge, to become effective upon the consummation of the Tributary Transactions, as described below

| Shareholders of the First Focus Large Cap Growth Fund |

Name Change: Change the name of First Focus and each Fund to be effected at the discretion of the Board.

| First Focus: Shareholders of all Funds, voting together

Each Fund: Shareholders of the respective Fund

|

PROPOSAL NO. 1 (ALL SHAREHOLDERS) – ELECTION OF NOMINEES TO THE BOARD

Under this proposal, the Board recommends that Shareholders of the Funds elect and re-elect each of the current directors to the Board: Michael Summers, Robert A. Reed, and Gary D. Parker, and elect a new director nominee, John J. McCartney, to fill an existing vacancy on the Board. First Focus will be managed by the directors in accordance with the laws of Nebraska governing corporations. The Board oversees all of the Funds. Directors serve until their respective successors have been elected and qualified or until their earlier death, resignation or removal. The directors appoint the officers of First Focus to actively supervise its day-to-day operations.

PROPOSAL NO. 2 (ALL SHAREHOLDERS) – TO APPROVE THE NEW INVESTMENT ADVISORY AGREEMENT

Under this proposal, the Board recommends that Shareholders of the Funds approve the New Investment Advisory Agreement between Tributary and First Focus, on behalf of all the Funds. FNB Fund Advisers (“FNB Advisers”), a division of First National Bank of Omaha, N.A. (“FNBO”), presently serves as the investment adviser to six of the eight Funds (the First Focus Short-Intermediate Bond Fund, the First Focus Income Fund, the First Focus Core Equity Fund, the First Focus Large Cap Growth Fund, the First Focus Small Company Fund, and the First Focus International Equity Fund (collectively, the “FNB Advised Funds”)), pursuant to an Investment Advisory Agreement, dated December 20, 1994, as amended December 5, 1995, June 4, 1996, February 14, 2005, and July 1, 2007 (the “Current FNB Advisory Agr eement”). Tributary presently serves as the investment adviser to the First Focus Balanced Fund and to the First Focus Growth Opportunities Fund (together, the “Tributary Advised Funds”), pursuant to an Investment Advisory Agreement, dated February 14, 2005 (the “Current Tributary Advisory Agreement,Company.” and together with the Current FNB Advisory Agreement, the “Current Master Advisory Agreements”).

FNB Advisers and Tributary are both owned, directly or indirectly, by First National of Nebraska, Inc., a Nebraska corporation (“FNNI”). By adopting this proposal, Tributary will be directly responsible for, and accountable to the Shareholders for, the investment performance of all eight Funds. The advisory fees to be paid to Tributary, its duties to each of the Funds, and its investment management operations and investment professionals will be substantially identical to those fees, duties, investment management operations, and investment professionals existing under (i) the Current FNB Advisory Agreement with respect to the FNB Advised Funds, and (ii) the Current Tributary Advisory Agreement with respect to the Tributary Advised Funds.

PROPOSAL NO. 3 (FIRST FOCUS BALANCED FUND SHAREHOLDERS ONLY) – TO APPROVE THE NEW FIRST NATIONAL SUB-ADVISORY AGREEMENT

Under this proposal, the Board recommends that Shareholders of the First Focus Balanced Fund approve the New First National Sub-Advisory Agreement between Tributary and FNFA with respect to the First Focus Balanced Fund. Tributary presently serves as the investment adviser to the First Focus Balanced Fund. FNFA is a separately-identifiable division of FNBFC, 205 West Oak Street, Fort Collins, Colorado 80521. By adopting this proposal, FNFA will offer certain sub-advisory services to aid Tributary in its responsibility and accountability for the investment performance of the First Focus Balanced Fund. The sub-advisory fees to be received by FNFA from Tributary are equal to an annual rate of 0.375% of the average daily net assets of the First Focus Balanced Fund, paid at the same time and in the same man ner as Tributary would be paid its advisory fee under the New Investment Advisory Agreement.

PROPOSAL NO. 4 (FIRST FOCUS INTERNATIONAL EQUITY FUND SHAREHOLDERS ONLY) – TO APPROVE THE NEW KBC SUB-ADVISORY AGREEMENT

Under this proposal, the Board recommends that Shareholders of the First Focus International Equity Fund approve the New KBC Sub-Advisory Agreement between KBC and Tributary with respect to the First Focus International Equity Fund. KBC presently serves as the sub-adviser to the First Focus International Equity Fund, pursuant to an Investment Sub-Advisory Agreement dated April 15, 2002 (the “KBC Sub-Advisory Agreement”). Pursuant to this proposal, KBC will continue to provide sub-advisory services and aid Tributary in its responsibility and accountability for the investment performance of the First Focus International Equity Fund. The sub-advisory fees to be received by KBC from Tributary are equal to an annual rate of 0.50% of the average daily net assets of the First Focus International Equity Fund, paid at the same time and in the same manner as Tributary would be paid its advisory fee under the New Investment Advisory Agreement.

PROPOSAL NO. 5 (FIRST FOCUS LARGE CAP GROWTH FUND SHAREHOLDERS ONLY) – TO APPROVE THE NEW RIVERBRIDGE SUB-ADVISORY AGREEMENT

Under this proposal, the Board recommends that Shareholders of the First Focus Large Cap Growth Fund approve the New Riverbridge Sub-Advisory Agreement between Riverbridge and Tributary with respect to the First Focus Large Cap Growth Fund. Riverbridge presently serves as the sub-adviser to the First Focus Large Cap Growth Fund, pursuant to an Investment Sub-Advisory Agreement effective July 1, 2007 (the “Riverbridge Sub-Advisory Agreement,” and collectively with the KBC Sub-Advisory Agreement and the Current Master Advisory Agreements, the “Current Advisory Agreements”). Pursuant to this proposal, Riverbridge will continue to provide sub-advisory services and aid Tributary in its responsibility and accountability for the investment performance of the First Focus Large Cap Growth Fund. The sub-advisory fees to be received by Riverbridge from Tributary are equal to an annual rate of 0.45% of the average daily net assets of the First Focus Large Cap Growth Fund, paid at the same time and in the same manner as Tributary would be paid its advisory fee under the New Investment Advisory Agreement.

PROPOSAL NO. 6 (ALL SHAREHOLDERS) – TO APPROVE THE POTENTIAL NAME CHANGE OF FIRST FOCUS AND EACH OF THE FUNDS

Under this proposal, the Board recommends that Shareholders of each of the Funds approve the Board’s ability to effectuate a name change for First Focus and each of the Funds at the Board’s discretion. Pursuant to this proposal, upon approval by Shareholders of Proposals (2) through (5), the Board may change the name of First Focus to Tributary Funds, Inc., and may change the name of each Fund as follows: Tributary Short-Intermediate Bond Fund; Tributary Income Fund; Tributary Balanced Fund; Tributary Core Equity Fund; Tributary Large Cap Growth Fund; Tributary Growth Opportunities Fund; Tributary Small Company Fund; and Tributary International Equity Fund. The purpose of this proposal is to conform the Funds’ names to the name of the new investment adviser to the Funds, Tributary.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR EACH PROPOSAL FOR WHICH YOU ARE ELIGIBLE TO VOTE.

SHAREHOLDER REPORTS

Unaudited financial statements of First Focus in the form of the Semi-Annual Report, dated September 30, 2009, and audited financial statements of First Focus in the form of the Annual Report, dated March 31, 2009, have been mailed to Shareholders before this proxy mailing. First Focus will furnish, without charge, a copy of the Annual Report or the Semi-Annual Report to any Shareholder who requests the report. Shareholders may obtain such reports by visiting www.firstfocusfunds.com; calling 1-800-662-4203; or by writing First Focus at 1620 Dodge Street, Mail Stop 1075, Omaha, Nebraska 68197.

BACKGROUND

DESCRIPTION OF THE TRANSACTION

Purchases of Membership Interests in Tributary

Subject to Shareholder approval, FNNI will engage in an internal reorganization of its subsidiaries, including FNB Advisers and Tributary. As part of this reorganization, FNBO has entered into an Interest Purchase Agreement (the “Purchase Agreement”) under which FNBO will purchase all of the outstanding interests in Tributary from FNBFC. Under the terms of the Purchase Agreement, all existing FNB Adviser personnel will become employees of Tributary, and such personnel, as applicable, will continue to service the Funds as they have previously (with such transactions collectively referred to as the “Tributary Transactions”).

The New Investment Advisory Agreement and the Tributary Transactions will enable the current managers and portfolio management teams of FNB Advisers to continue to advise the FNB Advised Funds. Shareholder approval of the New Investment Advisory Agreement is a condition to the closing of the Purchase Agreement.

The Purchase Agreement, if consummated, may be deemed to constitute an “assignment,” (as defined in the 1940 Act), of the Current Master Advisory Agreements. Accordingly, pursuant to the 1940 Act, the Current Master Advisory Agreements would terminate upon the consummation of the Purchase Agreement and the effectiveness of the New Investment Advisory Agreement. The consummation of the Purchase Agreement may also confer a benefit upon Tributary (within the meaning of Section 15(f) of the 1940 Act) because FNBO will purchase its interests. Section 15(f) of the 1940 Act permits Tributary to receive such benefit if (i) at least 75% of the Funds’ directors are not “interested

persons” (as defined in the 1940 Act) of either FNBO or Tributary for a period of three years from the consummation of the Purchase Agreement, and (ii) no unfair burden is imposed on the Funds as a result of the Tributary Transactions. Tributary believes that such requirements will be met if the Board’s independent director nominees are elected and re-elected, as applicable, under Proposal 1, and because none of the new advisory agreements to be approved by the Shareholders under Proposals 2 – 5 will result in any burden on any of the Funds, as described below under such Proposals.

Subject to Shareholder approval, the Tributary Transactions are expected to close on or about May 3, 2010. If any Shareholders do not approve their Fund’s New Investment Advisory Agreement, the appropriate parties will have no obligation to close the Purchase Agreement. Upon completion of the Tributary Transactions, Tributary will assume all operations, employees, rights, and obligations of FNB Advisers and FNB Advisers will terminate its current registration as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act’).

Subsequent Transfer of Interests in Tributary

After the completion of the Tributary Transactions, the integration of FNB Advisers’ personnel into Tributary, and the commencement of the New Investment Advisory Agreement between Tributary and the Funds, FNBO intends to transfer all of its interests in Tributary to either FNIB or FNNI (the “Follow On Transfer”). Due to the application of various regulatory provisions to FNNI and its subsidiaries in connection with the Follow On Transfer, the purchaser of Tributary has not been determined as of the date of this Proxy Statement. However, regardless of whether FNIB or FNNI purchase the interests in Tributary from FNBO, none of Tributary’s personnel or management will change in connection with the Follow On Transfer. Accordingly, the Follow On Transfer will not constitute an “assignmen t” of the New Investment Advisory Agreement by Tributary under the 1940 Act, and therefore neither the Funds nor the New Investment Advisory Agreement will be affected by the Follow On Transfer.

The consummation of the Follow On Transfer may also confer a benefit upon FNBO (within the meaning of Section 15(f) of the 1940 Act) because FNBO will sell its interests to an affiliate. Section 15(f) of the 1940 Act permits FNBO to receive such benefit if (i) at least 75% of the Funds’ directors are not “interested persons” (as defined in the 1940 Act) of either FNBO or Tributary for a period of three years from the consummation of the Follow On Transfer, and (ii) no unfair burden is imposed on the Funds as a result of the Follow On Transfer. FNBO believes that such requirements will be met if the Board’s independent director nominees are elected and re-elected, as applicable, under Proposal 1, and because none of the new advisory agreements to be approved by the Shareholders under Proposals 2 ̵ 1; 5 will result in any burden on any of the Funds, as described below under such Proposals.

Appointment of First National Fund Advisers as Sub-Adviser to First Focus Balanced Fund

In anticipation of the Tributary Transactions, FNFA, a new division of FNBFC, has been established. Pursuant to the New First National Sub-Advisory Agreement with Tributary, FNFA will offer certain sub-advisory services to aid Tributary in its responsibility and accountability for the investment performance of the First Focus Balanced Fund. The sub-advisory fees to be received by FNFA from Tributary are equal to an annual rate of 0.375% (37.5 bps) of the average daily net assets of the First Focus Balanced Fund, paid at the same time and in the same manner as Tributary would be paid its advisory fee pursuant to the New Investment Advisory Agreement.

Appointment of KBC as Sub-Adviser to First Focus International Equity Fund

Upon the consummation of the Rights Purchase Agreement, the existing KBC Sub-Advisory Agreement will terminate automatically. To enable KBC to continue serving as sub-adviser and aid Tributary in its responsibility and accountability for the investment performance of the First Focus International Equity Fund, Tributary and KBC will need to enter into the New KBC Sub-Advisory Agreement. With the exception of replacing FNBO with Tributary as the “Adviser” and a new effective date, the KBC Sub-Advisory Agreement and the New KBC Sub-Advisory Agreement are substantially identical.

Appointment of Riverbridge as Sub-Adviser to First Focus Large Cap Growth Fund

Upon the consummation of the Rights Purchase Agreement, the existing Riverbridge Sub-Advisory Agreement will terminate automatically. To enable Riverbridge to continue serving as sub-adviser and aid Tributary in its responsibility and accountability for the investment performance of the First Focus Large Cap Growth Fund, Tributary and Riverbridge will need to enter into the New Riverbridge Sub-Advisory Agreement. With the exception of replacing FNBO with Tributary as the “Adviser,” a new effective date, and shortening the notice requirement from sixty (60) days to thirty (30) days, the Riverbridge Sub-Advisory Agreement and the New Riverbridge Sub-Advisory Agreement are substantially identical.

CURRENT INVESTMENT ADVISERS

FNB Advisers, a division of FNBO, 1620 Dodge Street, Stop 1075, Omaha, Nebraska 68197 presently serves as the investment adviser to the FNB Advised Funds. FNB Advisers is a registered investment adviser under the Advisers Act. FNBO is a subsidiary of FNNI, a Nebraska corporation with total assets of about $19 billion as of December 31, 2009. FNBO offers clients a full range of financial services and has seventy years of experience in banking, trust, and financial investment management. As of December 31, 2009, First Investment Group, the investment division of FNBO which includes FNB Advisers, had $4.6 billion in assets under management. FNB Advisers acts through its Chief Financial Officer, and its employees. Steve Frantz, whose business address is 1620 Dodge Street, Stop 175, Om aha, Nebraska 68197, has been with FNB Advisers for ten years. Appendix A lists the current executive officers and directors of FNB Advisers.

Tributary, located at 215 West Oak Street, Fort Collins, Colorado 80521, is the investment adviser to the Tributary Advised Funds. Tributary is a wholly-owned subsidiary of FNBFC, which is a wholly-owned subsidiary of First National of Colorado, Inc., a locally-owned community bank holding company (“FNCI”), 205 West Oak Street, Fort Collins, Colorado 80521, which in turn is a wholly-owned subsidiary of FNNI. As of December 31, 2009, Tributary had approximately $233.9 million in assets under management. Tributary acts through its Managing Director, Kurt Spieler; its Senior Portfolio Manager, David Jordan; and its employees. Mr. Spieler, whose business address is 215 West Oak Street, Fort Collins, Colorado 80522, has been with Tributary for three years. Mr. Jordan, whose business a ddress is 215 West Oak Street, Fort Collins, Colorado 80522, has been with Tributary, and its predecessor, FNB Advisers, for more than fourteen years. Appendix A lists the current executive officers and directors of Tributary.

KBC is a subsidiary of KBC Asset Management Limited, located at Joshua Dawson House, Dawson Street, Dublin 2, Ireland, serves as the investment sub-adviser to the First Focus International Equity Fund. KBC, a registered investment adviser under the Advisers Act, provides investment advisory services to individuals, investment companies, and other institutions. As of December 31, 2009, KBC had $5.6 billion in assets under management. KBC is part of the KBC Bank and Insurance Group NV. KBC Group is a financial services group with headquarters in Brussels, Belgium. KBC acts through its Chief Executive Officer, Sean Hawkshaw, and its employees. Mr. Hawkshaw, whose business address is Joshua Dawson House, Dawson Street, Dublin 2, Ireland, has been with KBC for seventeen years. � 60;Appendix A lists the current executive officers and directors of KBC.

Riverbridge, located at Midwest Plaza West, 801 Nicollet Mall, Suite 600, Minneapolis, Minnesota 55402, serves as the investment sub-adviser to the First Focus Large Cap Growth Fund. Riverbridge, a registered investment adviser under the Advisers Act, provides investment advisory services to individuals, investment companies, and other institutions. As of December 31, 2009, Riverbridge had $1.731 billion in assets under management. Riverbridge has been a registered investment adviser since 1987. Riverbridge’s business address is Midwest Plaza West, 801 Nicollet Mall, Suite 600, Minneapolis, Minnesota 55402.

CURRENT ADVISORY AGREEMENTS

FNB Advisers and Tributary (together, the “Current Advisers”) supervise and administer the Funds’ respective investment programs. Supervised by the Board and following each Fund’s investment objectives and restrictions, each Adviser (or, as to the First Focus International Equity Fund and First Focus Large Cap Growth Fund, the sub-adviser): (i) manages a Fund’s investments, (ii) makes buy/sell decisions and places the related orders, and (iii) keeps records of purchases and sales. Investment decisions for the Funds are made by teams of adviser or sub-adviser personnel. In general, investment decisions are made by consensus, and no one person is primarily responsible for making investment recommendations. Each Fund’s respective portfolio management team is primarily r esponsible for day-to-day management of the Fund.

FNB Advisers provides investment advisory services to the FNB Advised Funds pursuant to the Current FNB Advisory Agreement. The Current FNB Advisory Agreement was most recently approved by the Board on May 18, 2009.

Tributary provides investment advisory services to the Tributary Advised Funds pursuant to the Current Tributary Advisory Agreement. The Current Tributary Advisory Agreement was most recently approved by the Board on May 18, 2009.

KBC provides investment sub-advisory services to FNB Advisers for the First Focus International Equity Fund pursuant to the KBC Sub-Advisory Agreement. The KBC Sub-Advisory Agreement was most recently approved by the Board on May 18, 2009.

Riverbridge provides investment sub-advisory services to FNB Advisers for the First Focus Large Cap Growth Fund pursuant to the Riverbridge Sub-Advisory Agreement. The Riverbridge Sub-Advisory Agreement was most recently approved by the Board on May 18, 2009.

The Current Advisory Agreements have existed since each Fund’s inception. As a result, the Current Advisory Agreements were approved by each Fund’s initial Shareholders and have not been otherwise submitted to a vote of the Funds’ Shareholders.

Unless otherwise terminated, after their initial terms, the Current Advisory Agreements remain in effect from year to year for successive annual periods ending on June 30 if, as to each Fund, such continuance is approved at least annually by (a) the vote of a majority of First Focus’ Board of Directors who are not “interested persons” (as defined in the 1940 Act), cast in person at a meeting called for the purpose of voting on such approval, and (b) the vote of a majority of First Focus’ Board of Directors or by the vote of a majority of all votes attributable to the outstanding shares of such Fund.

First Focus pays FNB Advisers and Tributary, for their services to the Funds, a fee based on an annual percentage of the average daily net assets of each Fund. The following table sets forth the advisory fees paid on behalf of each Fund for the fiscal year ended March 31, 2010, and identifies the respective adviser.

Fund | Advisory Fee |

First Focus Short-Intermediate Bond Fund | 0.50% (to FNB Advisers) |

First Focus Income Fund | 0.60% (to FNB Advisers) |

First Focus Balanced Fund | 0.75% (to Tributary) |

First Focus Core Equity Fund | 0.75% (to FNB Advisers) |

First Focus Large Cap Growth Fund | 0.90% (to FNB Advisers) |

First Focus Growth Opportunities Fund | 0.75% (to Tributary) |

First Focus Small Company Fund | 0.85% (to FNB Advisers) |

First Focus International Equity Fund | 1.00% (to FNB Advisers) |

For sub-advisory services provided by KBC to FNB Advisers with respect to the First Focus International Equity Fund, FNB Advisers pays KBC a sub-advisory fee at an annual rate of 0.50% of the average daily net assets of the First Focus International Equity Fund. For sub-advisory services provided by Riverbridge to FNB Advisers with respect to the First Focus Large Cap Growth Fund, FNB Advisers pays Riverbridge a sub-advisory fee at an annual rate of 0.45% of the average daily net assets of the First Focus Large Cap Growth Fund.

FNB Advisers and Tributary may choose to waive all or some of their advisory fees, as applicable, which will cause a Fund’s yield and total return to be higher than it would be without the waiver. Additionally, KBC and Riverbridge may choose to waive a portion of their sub-advisory fees. Currently FNB Advisers, Tributary, and Riverbridge have contractually agreed to fee waivers in the following amounts for the period August 1, 2009 through July 31, 2010:

Fund | Fee Waiver |

First Focus Short-Intermediate Bond Fund | 0.29% (from FNB Advisers) |

First Focus Income Fund | 0.47% (from FNB Advisers) |

First Focus Balanced Fund | 0.15% (from Tributary) |

First Focus Core Equity Fund | 0.15% (from FNB Advisers) |

First Focus Large Cap Growth Fund | 0.20% (from FNB Advisers) (0.10% from Riverbridge as sub-adviser) |

First Focus Growth Opportunities Fund | 0.15% (from Tributary) |

First Focus Small Company Fund | 0.15% (from FNB Advisers) |

First Focus International Equity Fund | 0.15% (from FNB Advisers) |

The following table sets forth the advisory fees, net of fee waivers, earned by FNB Advisers and Tributary for the fiscal year ended March 31, 2010:

Fiscal Year Ended March 31, 2010

| Fund | Fee Waivers | Advisory Fees Net of Fee Waivers |

| First Focus Short-Intermediate Fund | $ 178,337 | $ 129,141 |

| First Focus Income Fund | $ 279,558 | $ 65,587 |

| First Focus Balanced Fund | $ 38,451 | $ 153,802 |

| First Focus Core Equity Fund | $ 142,234 | $ 568,933 |

| First Focus Large Cap Growth Fund | $ 194,299 | $ 399,273 |

| First Focus Growth Opportunities Fund | $ 84,198 | $ 336,791 |

| First Focus Small Company Fund | $ 77,208 | $ 360,304 |

| First Focus International Equity Fund | $ 196,591 | $ 722,644 |

For the fiscal year ended March 31, 2010, the Funds paid no commissions on securities transactions to any broker affiliated with FNB, Tributary, or First Focus.

During the last fiscal year, contractual fee waivers on the First Focus Income Fund, the First Focus Large Cap Growth Fund, and the First Focus International Equity Fund were decreased. Effective August 1, 2009, (i) the First Focus Income Fund decreased its waiver from 52 bps to 47 bps, (ii) the First Focus International Fund decreased its waiver from 25 bps to 15 bps, and (iii) the First Focus Large Cap Growth Fund decreased its waiver from 45 bps to 20 bps.

There has been no material interest, direct or indirect, of any Director of the Funds in (i) any material transactions or (ii) any material proposed transactions since the beginning of the most recently completed fiscal year, to which the investment adviser of the Funds, any parent or subsidiary of the investment adviser (other than a Fund) or any subsidiary or parent of such entities was or is to be a party.

The Current Master Advisory Agreements, as required by the 1940 Act, each contain a provision requiring the agreement to terminate in the event of an “assignment.” Under the 1940 Act, a change of control of an investment adviser results in an assignment and termination of the adviser’s investment advisory contracts. As described above, Tributary and FNB Advisers are involved in the Tributary Transactions. Tributary may be deemed to undergo a change of control (as that term is used under the 1940 Act) upon consummation of the Tributary Transactions. Such a change of control may be deemed to result in the assignment of, and therefore the termination of, the Current Tributary Advisory Agreement. Additionally, pursuant to the Tributary Transactions, the Current FNB Advisory Agr eement will be assigned to Tributary. Therefore, upon the consummation of the Tributary Transactions, and subject to Shareholder approval, Tributary will become the sole investment adviser to all Funds.

As discussed below and taking into account that the investment professionals of FNB Advisers will be transferred to Tributary, neither the level nor the quality of the advisory services provided to each Fund nor the compensation paid for those services will change under the New Investment Advisory Agreement. With the exception of inserting Tributary as the investment adviser to the Funds, and different dates of effectiveness, the Current Master Advisory Agreements and the New Investment Advisory Agreement are substantially identical. With the exception of replacing FNBO with Tributary as the “Adviser” and a new effective date, the KBC Sub-Advisory Agreement and the New KBC Sub-Advisory Agreement are substantially identical. With the exception of replacing FNBO with Tributary as the “Adviser̶ 1;, a new effective date, and shortening the termination notice requirement from sixty (60) days to thirty (30) days, the Riverbridge Sub-Advisory Agreement and the New Riverbridge Sub-Advisory Agreement are substantially identical.

PROPOSAL 1

ELECTION OF NOMINEES TO THE BOARD

(ALL SHAREHOLDERS)

The Board recommends that the Shareholders of the Funds elect the current directorapprove a new sub-advisory agreement (the “New KBI Sub-Advisory Agreement”) between Tributary Capital Management, LLC (“Tributary”) and KBI, with respect to the Board: Michael Summers. The Board also recommends that Shareholders ofFund (the “Proposal”). KBI presently serves as sub-adviser to Tributary, the Funds re-elect the current directorsinvestment adviser to the Board: Robert A. Reed, and Gary D. Parker. The Board further recommends that Shareholders elect the new director nominee to fill an existing vacancy on the Board: John J. McCartney. Each nominee must be elected by a plurality of the shares of First Focus voted at the Meeting. Shares of each Fund will be counted together in determining the results of the voting for Proposal 1.

If any director standing for election shall by reason of death or for any other reason become unavailable as a candidate at the Meeting, votes pursuant to the enclosed proxy will be cast for a substitute candidate by the proxies named on the proxy card, present and acting at the Meeting. Any such substitute candidate for election as a director shall be made by a majority of the directors of the Funds who are not “interested persons” (as defined in the 1940 Act) (“Independent Directors”) of the Funds. The Board has no reason to believe that any current director will become unavailable for election as a director.

NOMINEES’ INFORMATION

Background

First Focus will be managed by the directors in accordance with the laws of Nebraska governing corporations. The Board oversees all of the Funds. Directors serve until their respective successors have been elected and qualified or until their earlier death, resignation or removal. The directors appoint the officers of First Focus to actively supervise its day-to-day operations.

Please see Appendix D to this Proxy Statement for the business addresses, ages, principal occupations during the last five years, other current directorships, ownership of shares in the Funds, compensation of the directors as well as the specific experience, qualifications, attributes, and skills that led to the conclusion that each person should serve as a director for the Funds.

Board Structure

Throughout its existence, the relative size of First Focus has been modest, as compared to many fund families. This is primarily because traditionally First Focus has been almost exclusively marketed to customers of First National Bank, and the Funds have not sought widespread distribution. Because of First Focus’ smaller size, for a number of years the structure of its Board has been smaller than is typical for larger scale fund families. Presently, the Board has three directors, two of whom are not “interested persons” (as defined in the 1940 Act) of either the Funds, the Funds’ respective investment advisers or the Funds’ various service providers. Upon the election of Mr. McCartney, the Board will be comprised of 75% Independent Directors.

Because of the Funds’ affiliation with the First National organization, First Focus has always had at least one director who is affiliated with First National, an arrangement which is quite common in the fund industry. Presently, the Funds’ one interested director meets the definition of “interested” under the 1940 Act because of his affiliation with First National, and serves as the Board’s Chairman. Given the relatively modest size of First Focus, we believe the Board’s structure comprised of 75% Independent Directors (upon the election of the additional Independent Director under Proposal 1) is appropriate, because the ratio of three Independent Directors to one interested director provides the Independent Directors with a distinct ability to influence the Board’s agenda and actions. A 75% majority of Independent Directors will provide an appropriate level of oversight of conflicts of interest among the Funds’ investment adviser, subadvisers and the Funds when considering the terms of any advisory contracts, as well as nominating directors to serve on the Board in the future.

Given the relatively modest size of First Focus, we do not believe that more than four directors are required at this time because the Board’s composition of four directors is sufficiently capable of performing its duties to the Funds. Should the size of the Funds materially increase or the Funds’ distribution strategies expand, the Board will re-evaluate the appropriateness of its size. Furthermore, in light of the Funds’ size and the limited size of its Board, the Board does not

presently consider diversity in its nominees for directors, but rather the Board focuses on each director’s ability to contribute to the Board’s oversight of the Funds. Accordingly, the Board has not adopted any policy requiring it or the Nominations Committee to specifically consider diversity when identifying director nominees.

Moreover, because the Board will have only three Independent Directors, First Focus does not believe that appointing a lead Independent Director would be particularly useful. Instead, all decisions with affiliated persons, and as described below, and all committee matters which should be decided by Independent Directors are determined by the three Independent Directors functioning as a committee, or as the only Independent Directors, as applicable.

The Board has formed two committees, the Audit Committee and the Nominations Committee, which are generally charged with determining First Focus’ most important corporate governance matters, such as reviewing the Funds’ reported financial information and nominating new directors for shareholder election. Both of those committees are now comprised solely of the two Independent Directors, and upon the election of a new Independent Director under Proposal 1, will be comprised of all three Independent Directors. Please see the description below regarding the specific responsibilities of those committees.

The Board’s role in overseeing the risks of First Focus begins with its duties imposed by it under both the 1940 Act and state corporate law—as the body which is charged with supervision of First Focus’ overall operations. In addition to reviewing periodic reports provided to the Board from the Funds’ various service providers, the Board meets, usually in person, at least quarterly to discuss the Funds’ operations, performance, and other matters such as review of any compliance concerns, if any. The Board has caused the Funds to engage with certain service providers which assist it in overseeing the Funds’ operations. For example, the Funds’ co-administrators are primarily responsible for assuring the Funds’ accounting is appropriately managed and the Funds’ internal operati ons are appropriately carried out, the Funds’ investment advisers are primarily responsible for implementing the Funds’ respective investment programs, and the Funds’ independent auditors are primarily responsible for conducting the annual audit of the Funds’ financial statements. The Board oversees the activities of all of these service providers.

In addition, the Board’s committee structure further enables it to oversee First Focus’ risks. The primary committee in this regard is the Audit Committee, which is comprised entirely of Independent Directors. The Funds’ independent auditors must report their findings and conclusions respecting their annual audit of the Funds’ financial statements. Furthermore, the Funds’ internal policies require service providers and other persons to report compliance and similar risk matters to the attention of the Audit Committee.

The Board has determined that its leadership structure is appropriate based on the size of First Focus, the Board’s current responsibilities, each of the director’s ability to participate in the oversight of First Focus, and committee transparency. As noted above, 75% of the Board will be (upon approval of Proposal 1) comprised of Independent Directors, and these Independent Directors serve on committees designed to facilitate the governance of First Focus and provide risk oversight. Additionally, the Board believes that its existing directors, as well as the director nominee, provide exceptional leadership and management experience to First Focus.

Beneficial Ownership

The table below sets forth the amount of Shares beneficially owned by each director and each nominee for election as director in each Fund stated as one of the following dollar ranges: None; $1-$10,000; $10,001-$50,000; $50,001-$100,000; or over $100,000. The information below is provided as of December 31, 2009.

| Independent Directors | Interested Director | Independent

Director Nominee

|

| Mr. Parker | Mr. Reed | Mr. Summers | Mr. McCartney |

First Focus Short-Intermediate Fund | None | None | None | None |

First Focus Income Fund | None | None | None | None |

First Focus Balanced Fund | None | None | None | None |

First Focus Core Equity Fund | None | None | None | None |

First Focus Growth Fund | None | None | None | None |

First Focus Small Company, Fund | None | None | None | None |

First Focus International Fund | None | None | $1-$10,000 | None |

First Focus Large Cap Fund | None | None | None | None |

All Funds in the Aggregate | None | None | $1-$10,000 | None |

Compensation

The following table sets forth certain information concerning compensation paid by First Focus to its directors in the fiscal year ended March 31, 2010.

Name and Position | Aggregate Compensation From First Focus | Pension or

Retirement

Benefits

Accrued as Part

of First Focus

Expenses | Estimated

Annual

Retirement

Benefits | Total Compensation From First Focus |

Independent Directors | | | |

Gary D. Parker Director | $9,000 | 0 | 0 | $9,000 |

Robert A. Reed Director | $9,000 | 0 | 0 | $9,000 |

| Interested Director | | | |

Michael Summers President and Director | 0 | 0 | 0 | 0 |

The officers of First Focus receive no compensation directly from First Focus for performing the duties of their offices. The officers of First Focus, may, from time to time, serve as officers of other investment companies. Jackson Fund Services (“JFS”), a division of Jackson National Asset Management, LLC, as the Funds’ Co-Administrator, receives fees from each of the Funds for acting as Co-Administrator. Mr. Koors, Ms. Bugni, and Ms. Hernandez are employees of, and are compensated by, JFS. Beacon Hill Fund Services, Inc. (“Beacon Hill”), provides the Funds with certain compliance services. Mr. Ruehle is an employee of Beacon Hill, and as such, is compensated by Beacon Hill.

Board Meeting Attendance

During the fiscal year ended March 31, 2010, the Board held five meetings. Each of the Directors attended at least 75% of the aggregate of the total number of meetings of the Board, and the total number of meetings held by all committees of the Board on which he served. First Focus encourages all of its directors to attend its Shareholders’ meetings, though First Focus did not hold a Shareholders’ meeting last year.

Committees

The Board has established the following committees:

Audit Committee. The Board’s Audit Committee is responsible for, among other things, reviewing and recommending to the Board the selection of the Funds’ independent registered public accounting firm, reviewing the scope of the proposed audits of the Funds, reviewing the results of the annual audits of the Fund’s financial statements with the independent registered public accounting firm and interacting with the Fund’s independent auditors on behalf of the full Board. The Audit Committee currently consists of each of the Independent Directors. The Audit Committee held three meetings during the fiscal year ended March 31, 2010.

Nominations Committee. The Nominations Committee is responsible for screeningFund, pursuant to an interim sub-advisory agreement between Tributary and nominating candidates for election toKBI effective October 11, 2010 (the “Interim KBI Sub-Advisory Agreement”) that was approved by the Board as Independent Directors of the Funds. The Nominations Committee is comprised of the Independent Directors. The Nominations Committee held oneat an in-person meeting during the fiscal year ended March 31,on October 8, 2010. The Nominations Committee has adoptedInterim KBI Sub-Advisory Agreement is set to expire on March 10, 2011 or the date a Charter effective November 15, 2004. The Committee has established a policy that it will receive and consider recommendations for nomination of Independent Director candidates from other persons, includingdefinitive sub-advisory contract is approved by the Shareholders of the Funds. Recommendations can be submitted to: First Focus Funds, Inc., 1620 Dodge Street, Mail Stop 1071, Omaha, NE 68102, Attention: Chairman, Nominations Committee.

In considering candidatesFund. Please see Appendix C for selection or nomination to the Board, the Nominations Committee will consider various factors, including a candidate’s education, professional experience (including experience in the insurance and mutual fund industries), the results of in-person meetings with the candidate, the views of managementcopy of the Advisers with respect to the candidate, the candidate’s other business and professional activities, and other factors that may be deemed relevant by the Nominations Committee.proposed New KBI Sub-Advisory Agreement.

Fair Value Committee. The Board has a standing Fair Value Committee that is composed of various representatives of First Focus’ service providers, as appointed by the Board. The Fair Value Committee operates under procedures approved by the Board. The principal responsibilities of the Fair Value Committee are to determine the fair value of securities for which current market quotations are not readily available. The Fair Value Committee meets periodically, as necessary, and met four times during the fiscal year ended March 31, 2010.

PROPOSAL 2

APPROVAL OF

NEW INVESTMENT ADVISORY AGREEMENT BY AND BETWEEN TRIBUTARY AND FIRST FOCUS,

ON BEHALF OF EACH OF THE FUNDS

(ALL SHAREHOLDERS MUST APPROVE)

REQUIRED VOTERequired Vote

Approval of the New Investment Advisory Agreement appointing Tributary as investment adviser to all of the Funds requires the affirmative vote of a majority of the outstanding voting securities of each Fund. Under the 1940 Act, a majority of each Fund’s outstanding voting securities is defined as the lesser of (i) 67% of the outstanding shares represented at a meeting at which more than 50% of each Fund’s outstanding shares are present in person or represented by proxy, or (ii) more than 50% of each Fund’s outstanding voting securities. If the New Investment Advisory Agreement is not so approved by each Fund’s Shareholders, Tributary will continue to serve as investment adviser to the Tributary Advised Funds at the current fee level under the Current Tributary Advisory Agreement, and FNB Advisers wil l continue to serve as investment adviser to the FNB Advised Funds at the current fee level under the terms of the Current FNB Advisory Agreement.

CURRENT AND NEW ADVISORY AGREEMENTS

Except for differences in the effective and renewal dates, the Current Master Advisory Agreements and the New Investment Advisory Agreement are substantially similar. A form of the New Investment Advisory Agreement is attached to this Proxy Statement as Appendix B. Under the New Investment Advisory Agreement, Tributary would perform the same services it currently performs with respect to the Tributary Advised Funds and would perform the same services currently performed by FNB Advisers with respect to the FNB Advised Funds. With the sole exception of Kurt Spieler, who will join FNBFC, the portfolio managers, portfolio management team, and investment programs are expected to continue substantially unchanged as a result of the Tributary Transactions. Additionally, no further changes to Tributary’s personnel or management will occur in connection with the Follow On Transfer.

Pursuant to both the Current Master Advisory Agreements and the New Investment Advisory Agreement, the investment adviser to the Funds is responsible for providing a continuous investment program for the Funds, including the provision of investment research and management with respect to all securities and investments and cash equivalents purchased, sold, or held in the Funds, and the selection of brokers and dealers through which securities transactions for the Funds are executed. The investment adviser performs its responsibilities subject to the supervision of, and policies established by, the Board.

Although Tributary intends to devote such time and effort to the business of the Funds as is reasonably necessary to perform its duties to First Focus, both the Current Master Advisory Agreements and the New Investment Advisory Agreement acknowledge that the services of Tributary are not exclusive, and Tributary may provide similar services to other investment companies and other clients and may engage in other activities (though Tributary does not currently provide similar services to other investment companies).

Under both the Current Master Advisory Agreements and the New Investment Advisory Agreement, the investment adviser bears all expenses incurred by it in performing its duties as investment adviser, including but not limited to, expenses related to all office space, facilities, equipment, and clerical personnel necessary for the investment adviser to carry out its duties and obligations under the respective agreement, but excluding the cost of securities, commissions, and transfer taxes, if any, purchased for the Funds. Each of the Funds bears the following expenses relating to its operations: organizational expenses, taxes, interest, any brokerage fees and commissions, fees of the directors of First Focus, Securities and Exchange Commission (“SEC”) fees, state securities registration fees and expenses, costs of preparing and printing prospectuses for regulatory purposes and for distribution to a Fund’s current and prospective Shareholders, outside auditing and legal expenses, advisory and administration fees, fees and out-of-pocket expenses of the custodian and transfer agent, costs of Fund accounting services, certain insurance premiums, costs of maintenance of First Focus’ existence, costs of Shareholders’ and directors’ reports and meetings, distribution expenses, Shareholder servicing expenses incurred pursuant to First Focus’ Administrative Services Plan and other similar arrangements, any extraordinary expenses incurred in the Fund’s operation, and other operating expenses not assumed by First Focus’ service providers.

The New Investment Advisory Agreement provides for the furnishing of the same advisory services for the same advisory fees as the Current Master Advisory Agreements. Additionally, both the Current Master Advisory Agreements and the New Investment Advisory Agreement provide, among other things, that in any fiscal year the aggregate expenses of any of the Funds (as defined under the securities regulations of any state having jurisdiction over First Focus) exceeds the expense limitations of any such state, the investment adviser will reimburse the Fund for such excess expenses; provided, that the obligation of the investment adviser to reimburse the Funds is limited to the amount of its fee for such fiscal year. Notwithstanding the foregoing, both agreements also provide that the investment adviser must reimburse the Funds for such excess expenses regardless of the amount of fees paid to it during such fiscal year to the extent required by securities regulations of any state having jurisdiction over First Focus.

The Current Master Advisory Agreements and the New Investment Advisory Agreement provide that the investment adviser is entitled to receive a fee, payable monthly, at an annual rate based of the average daily net assets of each Fund. The fees for each Fund under the New Investment Advisory Agreement are the same as under the Current Master Advisory Agreements, as set forth above in the discussion under the heading “Current Advisory Agreements.” Additionally, the current fee waivers agreed to by each Current Adviser, on behalf of the Funds and as set forth above in the discussion under the heading “Current Advisory Agreements,” remain unchanged under the New Investment Advisory Agreement.

The Current Master Advisory Agreements and the New Investment Advisory Agreement provide that the investment adviser shall not be liable for any error of judgment or mistake of law or for any loss suffered by the Funds in connection with the performance of the respective investment advisory agreement, except a loss resulting from a breach of a

fiduciary duty with respect to the receipt of compensation for services or a loss resulting from willful misfeasance, bad faith, or gross negligence on the part of the investment adviser in the performance of its duties or from reckless disregard by it of its obligations and duties under the investment advisory agreement.

The Current Master Advisory Agreements and the New Investment Advisory Agreement are renewable annually, with respect to a Fund by (i) the vote of a majority of those members of the Board who are not parties to the agreement or “interested persons” of any such party (as defined in the 1940 Act), cast in person at a meeting called for the purpose of voting on such approval; and (ii) the vote of a majority of all of the members of the Board or by vote of the holders of “a majority of the outstanding voting securities” of a Fund (as defined in the 1940 Act).

The Current Master Advisory Agreements and the New Investment Advisory Agreement terminate automatically if assigned (as defined in the 1940 Act) and may be terminated by either party thereto at any time, without penalty, on sixty (60) days’ written notice.

BASIS FOR THE BOARD RECOMMENDATION

At an in-person meeting of the Board held on February 24, 2010, the Board, including the directors who are neither (i) parties to the advisory contract nor (ii) “interested persons” (as defined in the 1940 Act) of either the Funds or any of the investment advisers, unanimously concluded that the New Investment Advisory Agreement is in the best interests of the Funds and their Shareholders, and approved, and voted to recommend to the Shareholders of each Fund that they approve, the New Investment Advisory Agreement. At a second meeting of the Board on March 29, 2010, the Board reviewed the terms of the Follow On Transfer and determined that no changes would occur to either the personnel or the management of Tributary in connection with the Follow On Transfer.

In approving the New Investment Advisory Agreement, the Board took into account that the provisions of the Current Master Advisory Agreements and the New Investment Advisory Agreement are substantially identical. The Board also noted that neither the Funds nor their Shareholders will pay any of the costs and expenses incurred by the Funds associated with the Tributary Transactions, including the consummation of the Purchase Agreement, as well as the Funds’ expenses incurred to obtain Shareholder approvals and associated regulatory requirements.

In considering the New Investment Advisory Agreement, the Board requested and received information from Tributary and FNB Advisers regarding the Tributary Transactions. Those materials included information regarding Tributary, FNB, and their affiliates, and their personnel, operations, and financial condition. Additionally, senior officers of Tributary and FNB Advisers were present to answer questions from the Board. The Board also met and conferred with representatives of Tributary, FNB Advisers, FNBO, and FNNI. In approving the proposed New Investment Advisory Agreement, the Board considered a number of factors, including those discussed below.

Nature, Extent, and Quality of Services to be Provided by the Investment Adviser. The Board received and considered a variety of information pertaining to the nature, extent, and quality of services to be provided by Tributary, as reorganized following the Tributary Transactions (“New Tributary”). The Board recognized that New Tributary would remain the investment adviser to the Tributary Advised Funds, and that KBC and Riverbridge would to continue to sub-advise the First Focus International Equity Fund and First Focus Large Cap Growth Fund, respectively. Accordingly, the Board paid particular attention to the impact that the Tributary Transactions would have on the management of the First Focus Short-Intermediate Bond Fund, the First Focus Inc ome Fund, the First Focus Core Equity Fund, the First Focus Large Cap Growth Fund, the First Focus Small Company Fund, and the First Focus International Equity Fund (the Funds not previously advised by Tributary). Representatives of Tributary and FNB Advisers discussed with the Board the philosophy of management, performance expectations, and methods of operation of FNB Advisers insofar as they related to First Focus and indicated their belief that, as a consequence of the Tributary Transactions, the operations and service capabilities of Tributary would be enhanced by the resources of New Tributary. In its review of the nature, extent, and quality of services to be provided by New Tributary to the Funds, the Board also considered the following:

· | The professional qualifications and experience of the portfolio management teams for each of the Funds are expected to remain in place following the closing of the Tributary Transactions. |

· | The overall high quality of the personnel, operations, financial condition, investment management capabilities, methodologies, and performance of New Tributary should benefit the Funds following the closing of the Tributary Transactions. |

· | New Tributary’s organization, resources, and research capabilities will be substantially identical with those of FNB Advisers. |

· | There is an apparent absence of potential conflicts of interest in having New Tributary serve as the sole investment adviser to the Funds. |

· | New Tributary will not be bound by any capital limitations of FNBO and FNBFC, which the Board believes could allow New Tributary to offer additional advisory services to benefit First Focus and the Funds. |

· | The Board found no material compliance, regulatory, or litigation concerns, and the Board reviewed New Tributary’s compliance strategies and found them in line with those of FNB Advisers and Tributary. The Board confirmed that New Tributary has adopted and maintained written procedures, which are in accordance with the Advisers Act and consistent with the standards set forth in the 1940 Act. |

· | New Tributary’s portfolio transaction execution and soft dollar policies and practices are consistent with those currently followed by FNB Advisers and Tributary. |

· | New Tributary’s operations and facilities would include the current operations and facilities of FNB Advisers. |

· | New Tributary’s policies and procedures for allocating transactions among accounts would remain consistent with those currently followed by FNB Advisers and Tributary. |

· | The range of New Tributary’s service offerings, including investment analysis, investment management, trading of portfolio securities, proxy voting, valuation of portfolio securities, administering the Funds’ business affairs, and providing accounting, legal, compliance, record-keeping, and related services, would remain consistent with those currently provided by FNB Advisers and Tributary. |

After reviewing this information and discussing it with representatives of Tributary and FNB Advisers, the Board concluded that it was satisfied with the nature, extent, and quality of the services to be provided by New Tributary. In particular, the Board determined that the FNB Advised Funds would benefit from having New Tributary serve as their investment adviser as a result of the greater depth of the portfolio management team and greater distribution opportunities.

Investment Performance. The Board received information regarding the performance of Funds currently managed by Tributary and FNB Advisers. Because of the combination of personnel and resources at the closing of the Tributary Transactions, the Board determined that the investment experience of New Tributary would be sufficient to sustain, and even improve, the investment performance of the Funds currently managed by FNB Advisers and Tributary separately. The Board noted that the investment objective and principal investment strategies of each Fund are expected to continue substantially unchanged. The Board also noted that the investment performance of each Fund for the three months and year ended December 31, 2009, has been comparable to, and in s ome cases exceeded, fund indices for the same periods.

Cost of Services Provided and Profitability. The Board considered the projected assets under management of New Tributary and determined that, based on the limited size of assets under management, fee breakpoints were not justified. The Directors reviewed and considered the advisory fee that would be payable by each Fund to New Tributary in light of the nature, extent, and quality of the management services expected to be provided by New Tributary, including any fee waivers and/or expense reimbursement arrangements currently in place and expected to continue following the closing of the Tributary Transactions. As noted above, all current advisory fees, which the Board has previously determined to be fair and reasonable, are expected to continue at their exis ting rates listed above in the discussion of the “Current Advisory Agreements.” All current fee waivers also are expected to continue following the closing of the Tributary Transactions. Additionally, the Directors received and considered information comparing each Fund’s advisory fees and overall expenses with those of comparable funds. The Board considered that other investment advisers managing certain other mutual funds with similar investment objectives or principal investment strategies as the Funds may charge lower management fees than those proposed by New Tributary. The Board also considered New Tributary’s projected and historical revenues, costs, assets, liabilities, and profitability in relation to the fees payable to New Tributary following the closing of the Tributary Transactions. The Board noted that New Tributary, not the Funds or First Focus, will pay the sub-advisory fees to KBC, Riverbridge and FNFA.

The Board also evaluated New Tributary’s proposed method for determining compensation for each portfolio manager. Following the reorganization, Tributary will pay portfolio managers a fixed salary based upon experience and market

value norms. Participation in the parent organization’s defined contribution 401(k) plan is voluntary and each portfolio manager is eligible to receive a bonus, which is paid annually and calculated as a percentage of base salary and is dependent upon Fund pre-tax performance versus Fund benchmarks.

Based on the foregoing information, the Board concluded that the proposed advisory fees and total expenses to be borne by the Funds under the New Investment Advisory Agreement are reasonable in relation to the services to be provided, and that the investment adviser’s level of profitability from its proposed New Investment Advisory Agreement with the Funds also was reasonable. Additionally, given the nature and quality of New Tributary’s expected services, the benefits expected to be received by the Funds, and the nature and extent of expected non-advisory services offered by New Tributary, the Board found New Tributary’s proposed fee acceptable.

Economies of Scale. The Board considered a variety of other benefits to be realized by New Tributary as a result of New Tributary’s relationship with the Funds, including fees for administrative services provided for the benefit of certain Funds. The Board has reviewed New Tributary’s portfolio trading practices and evaluated them in light of the current practices of the Current Advisers. The Board took these ancillary benefits into account in evaluating the reasonableness of the advisory fees paid to New Tributary. The Board also noted that New Tributary may realize modest economies of scale based on the Tributary Transactions and synergies of operations, but that because the Funds’ sizes are not expected to materially increase , utilizing a break point system in the Funds’ fee structure to accounts for economies of scale may not be appropriate at this time.

Adviser Financial Information. The Board reviewed information regarding New Tributary’s projected costs of providing services to the Funds, including personnel, systems, and the resources of investment, compliance, trading, accounting, and other administrative operations. It considered New Tributary’s projected costs and willingness to invest in technology, infrastructure, and staff to maintain and expand services and capabilities, respond to industry and regulatory developments, and attract and retain qualified personnel. It noted information received regarding the compensation structure for New Tributary’s investment professionals. The Board noted the competitiveness and cyclicality of both the mutual fund industry and the capital market s, and the importance to the Funds in that environment of New Tributary’s long-term profitability for maintaining its independence, company culture, and management continuity. The Board concluded that the Funds’ advisory fee structures under the New Investment Advisory Agreement reflected a reasonable sharing of benefits between New Tributary and the Funds’ Shareholders. The Board also considered the financial capabilities and balance sheet of the FNIB and FNNI, New Tributary's respective direct and indirect owners. Based on that information and the historical financial stability of FNNI as it relates to the previous operations of FNB Advisers and Tributary, the Board concluded that New Tributary would be sufficiently capitalized to satisfy its obligations to the Funds.

Employment Arrangements. The Board also considered the consistency of the portfolio managers following the Tributary Transactions. As a result of the Tributary Transactions, personnel of FNB Advisers who currently manage FNB Advised Funds are expected to continue managing these Funds as personnel of Tributary. Further, the Board considered that Tributary does not intend to make any material changes to Tributary’s or FNB Advisers’ human or other resources that would adversely impact Tributary’s ability to provide the same quality of advisory services that it has provided in the past. Finally, the Board considered its familiarity and relationships with the existing portfolio managers of the Funds and its satisfaction with the expe rience and qualifications of such portfolio managers.

Legal Considerations. Based on information provided by Tributary and its independent counsel, the Board believes applicable federal and state legal requirements will continue to be satisfied after the Tributary Transactions and the Follow On Transfer. The Board conducted a review of New Tributary and its affiliates’ history of regulatory compliance and found the results to be satisfactory. The Board also considered Tributary’s prior ability to satisfy compliance obligations. Additionally, the Board reviewed Tributary’s current Code of Ethics and found no material discrepancies between it and FNB’s existing Code of Ethics. The Board is not aware of any pending or anticipated legal proceedings or investigations in volving Tributary or its affiliates.

Other Considerations. Because the Board noted the Current Advisory Agreements and the New Investment Advisory Agreement are substantially identical, the Board also considered the information that had been received, the factors that had been identified, and the conclusions that had been reached by the Board in connection with its most recent approval or continuance of each Fund’s current investment advisory agreement. The Board also identified and considered the benefits that are anticipated to accrue to Tributary because of its relationship with the Funds. Such benefits include greater assets under management, resulting in recruiting high quality staff, supporting research services, more favorable commission rates, and enhanced marketing. T he Board also has determined that no changes will occur to New Tributary in connection with the Follow On Transfer, other than the immediate FNNI affiliate which will hold the interests in New Tributary.

In light of all of the foregoing, the Board, including all of the members who are not “interested persons” (as defined in the 1940 Act) of either the Funds or the investment advisers, or parties to the New Investment Advisory Agreement, approved the New Investment Advisory Agreement. No single factor reviewed by the Board was identified as the principal factor in determining whether to approve the New Investment Advisory Agreement, and each director attributed different weight to the various factors. Accordingly, the Board, including all Independent Directors, unanimously approved the New Investment Advisory Agreement and voted to recommend its approval to the respective Fund’s Shareholders.

PROPOSAL 3

APPROVAL OF

NEW FIRST NATIONAL SUB-ADVISORY AGREEMENT BETWEEN FNFA

AND TRIBUTARY, WITH RESPECT TO THE FIRST FOCUS BALANCED FUND

(FIRST FOCUS BALANCED FUND SHAREHOLDERS ONLY)

REQUIRED VOTE